Encountering a disagreement with your insurance company can be a frustrating experience. But, by following a methodical approach, you can increase your chances of achieving a favorable outcome. Begin by carefully examining your policy documents to understand your benefits. Document all communication with the insurance company, including dates, times, and names of individuals you speak with. In the event that you are finding it difficult to settle the dispute amicably, consider seeking legal counsel. A qualified attorney can assist you through the judicial process and represent on your behalf.

- Keep detailed records of all relevant information, including emails, invoices, together with any other supporting evidence.

- Comprehend your policy's terms and clauses to determine your rights.

- Communicate with the insurance company in a professional and courteous manner.

Winning Your Insurance Claim: Strategies for Success

Securing a successful payment from your insurance claim can feel like navigating a labyrinth. Don't worry! By following these key approaches, you can boost your chances of a positive result. First and foremost, carefully review your policy documents. Familiarize yourself with the specifics regarding your coverage limits and the procedure for filing a claim. Swiftly report any incident to your insurance company, providing them with accurate information about the situation.

Keep detailed records of all communication with your insurer, including dates, times, and participants involved. Capture any damage or injuries pertinent to your claim. This evidence will be crucial in validating your case.

Consider reaching out to an experienced insurance claims adjuster. They can guide you through the process, represent your best interests, and help ensure a fair resolution. Remember, being persistent and well-informed is essential for securing a successful insurance claim.

Fight Back Against Insurance Roadblocks

Dealing with an insurance company that's giving you the runaround can be incredibly frustrating. But don't throw in the towel! You have leverage and there are steps you can take to get the claim you deserve.

First, make sure your documentation is impeccable. Gather all relevant records and send them in a timely manner. If your initial claim is denied, don't lose get more info hope. Carefully review the reason for the denial and see if there are any inaccuracies you can address.

Then, consider reviewing the decision. You may want to seek advice from an insurance lawyer who can help you navigate the procedure. Remember, persistence and attention to detail are key to overcoming insurance company pushback.

Understanding Your Policy and Rights in an Insurance Dispute

Navigating an policy dispute can be a complex process. It's crucial to thoroughly review your agreement documents to understand the terms, conditions, and coverage limits that apply to your situation.

Your policy will outline the particular circumstances under which your insurer is required to deliver coverage. It's also important to become yourself with your legal privileges as an insured party. These rights may include the ability to contest a refusal of coverage or demand a formal review of your claim.

If you encounter difficulties understanding your policy or believe your rights have been violated, it's advisable to speak with an experienced insurance agent. They can assist you in analyzing your policy language and evaluate available options to settle the dispute.

Resolving Issues with Your Insurer

When conflicts arise with your insurance provider, clear and concise communication is paramount. Begin by carefully reviewing your policy documents to grasp your coverage and any relevant exclusions. Log all interactions with the insurance company, including dates, times, names of representatives, and summary. When contacting the provider, remain composed and courteous. Articulate your concerns in a organized manner, providing supporting evidence where applicable. Be persistent in seeking a fair resolution. If you experience difficulty settling the issue directly with the provider, consider escalating your case to their customer service department or an independent insurance ombudsman.

Typical Insurance Claim Pitfalls and How to Avoid Them

Filing an insurance claim can be a tricky process, and navigating it successfully requires careful attention to detail. There are several common pitfalls that claimants often encounter, which can lead to delays or even denials. To ensure a smooth claims process, it's essential to understand these potential problems and take steps to avoid them.

One frequent mistake is presenting an incomplete application. Be sure to supply all the necessary information and documentation, as missing details can lead to your claim being put on hold. It's also crucial to report your insurer about any changes to your situation promptly. Failure to do so could invalidate your coverage and leave you unprotected in case of a future event.

Another common pitfall is exaggerating the extent of your losses. While it's understandable to want to receive full compensation, being dishonest about damages can lead serious problems. Your insurer has ways to verify claims, and any discrepancies will likely lead to a denied claim or even legal action.

Remember, honesty and transparency are key when dealing with insurance claims. By avoiding these common pitfalls and following best practices, you can increase your chances of a successful outcome.

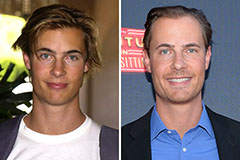

Erik von Detten Then & Now!

Erik von Detten Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Elisabeth Shue Then & Now!

Elisabeth Shue Then & Now! Barbara Eden Then & Now!

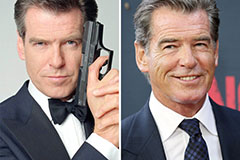

Barbara Eden Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!